Buying points essentially means you agree to pay more upfront costs in exchange for a lower monthly payment.

If you intend on keeping your home for a while, you could consider buying points to reduce your interest rate. Depending on your loan amount, a lower LTV may increase the likelihood of you of being offered a low interest rate. The amount of your down payment compared to the total amount of the loan is called your loan-to-value ratio (LTV). Increasing your down payment can be one way to help you qualify for a lower interest rate. This mortgage calculator shows your mortgage costs with PMI However, to ensure your home is covered for damage caused by fires, lightning strikes, and natural disasters that can affect your area, most people would recommend keeping it.

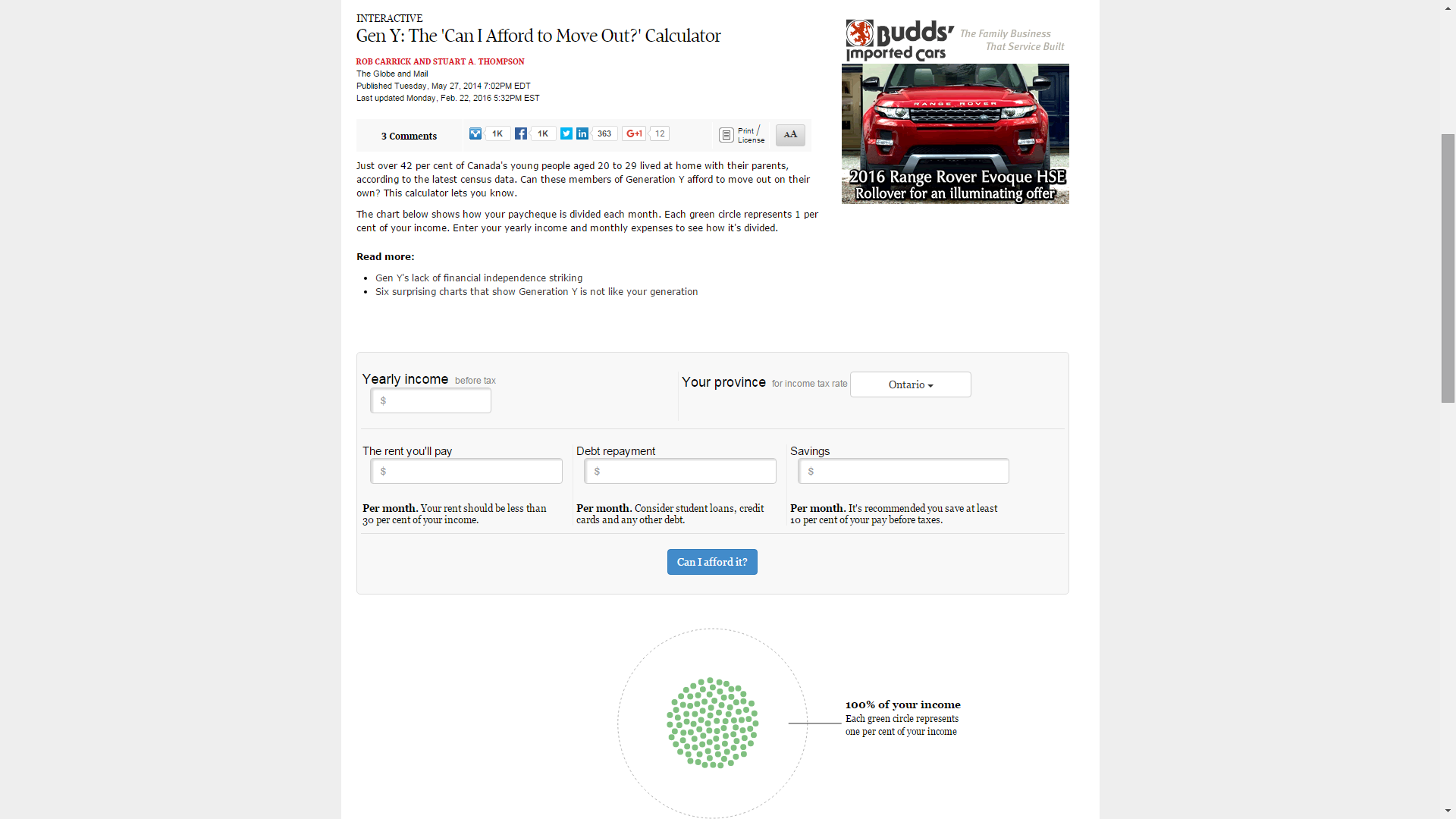

HOUSE FINANCE CALCULATOR FREE

Lenders do this because they know from experience that no one wants to pay a mortgage on a property that’s burned down, damaged, or destroyed.įun fact: When you own your home free and clear, the decision to keep homeowners insurance is all yours. Your lender will typically insist on you having homeowners insurance while you’re paying off your mortgage. If you fall behind on your property taxes, you could end up losing your home to your local tax authority. Once your mortgage is paid off, you’ll still be required to pay property taxes. These services include schools, libraries, roads, parks, water treatment, the police, and the fire department. The property taxes you pay help fund the services your local government provides for the community. Often these costs will be rolled in with your mortgage payments as it’s important-to both you and your lender-that these bills stay current to protect your investment. When you own a home, you’re responsible for paying property taxes and homeowners insurance. Buying in an area with a lower property tax rate may make it easier for you to afford a higher-priced home. To see how much home you can afford including these costs, take a look at the Better home affordability calculator.įun fact: Property tax rates are extremely localized, so 2 homes of roughly the same size and quality on either side of a municipal border could have very different tax rates. The only amounts we haven’t included are the money you’ll need to save for annual home maintenance/repairs or the costs of home improvements. If you’re thinking about buying a condo or into a community with a Homeowners Association (HOA), you can add HOA fees. As the costs of utilities can vary from county to county, we’ve included a utilities estimate that you can break down by service.

If you enter a down payment amount that’s less than 20% of the home price, private mortgage insurance (PMI) costs will be added to your monthly mortgage payment. Play around with different home prices, locations, down payments, interest rates, and mortgage lengths to see how they impact your monthly mortgage payments. So you can really crunch the numbers, we’ve included all the typical monthly costs you’ll be responsible for once you own a home. The most popular place to start is our borrowing calculator or our affordability calculator.Your monthly mortgage costs include more than just loan payments and interest. Which mortgage calculator is right for me? Our calculators give you a idea of what you might be able to borrow from us to buy a home, and what your monthly and total mortgage payments could be, for different types of mortgages. We won’t ask about groceries, utility bills or travel. Why you’re applying – for example, buying your first home, moving home, or buying a second home.How much you regularly spend – on things like your credit or store cards, loans, overdrafts, maintenance and pension.When you apply for a mortgage or use our calculator, we’ll ask you for information like

What information do I need to use a calculator and how do you decide what I can afford? It’s for you if you’re a first time buyer, you’re looking to remortgage, move or buy an additional home, or you’re a buy-to-let landlord. We have different calculators that can help you in different ways – each calculator does something slightly different. It’s a tool that gives you an estimate of how much you could borrow from us or what your monthly repayments and other costs might be, for a mortgage in the UK.

0 kommentar(er)

0 kommentar(er)